Table of Content

Itemizing deductions allows some taxpayers to reduce their taxable income, and thus their taxes, by more than if they used the standard deduction. If you elect to deduct state and local sales taxes instead of income taxes (you can’t deduct both), you can use your actual expenses or the optional sales tax tables found in Schedule A . If you refinanced your loan or took out a home equity line of credit , you receive a deduction for points over the life of the loan. Each time you make a mortgage payment, a small percentage of the points is built into the loan. You can deduct that amount for each month that you made payments.

For more information go to MilitaryOneSource (MilitaryOneSource.mil/Tax). Remove from this record any improvements that are no longer part of your main home. For example, if you put wall-to-wall carpeting in your home and later replace it with new wall-to-wall carpeting, remove the cost of the first carpeting. You put wall-to-wall carpeting in your home 15 years ago.

Private Mortgage Insurance Deduction

Better Real Estate employs real estate agents (“Better Real Estate Agents”) and also maintains a nationwide network of partner brokerages and real estate agents (“Better Real Estate Partner Agents”). If you withdraw after-tax money from a Roth IRA or a traditional IRA you’ll need to file form 8606. According to the IRS, points can be deducted ratably over the life of the loan or deducted all at once in the year that they were paid. It’s also possible to fully deduct points paid on a loan to improve your main home if it meets certain criteria. TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems you’ve seen in your practice. Use the Offer in Compromise Pre-Qualifier to see if you can settle your tax debt for less than the full amount you owe.

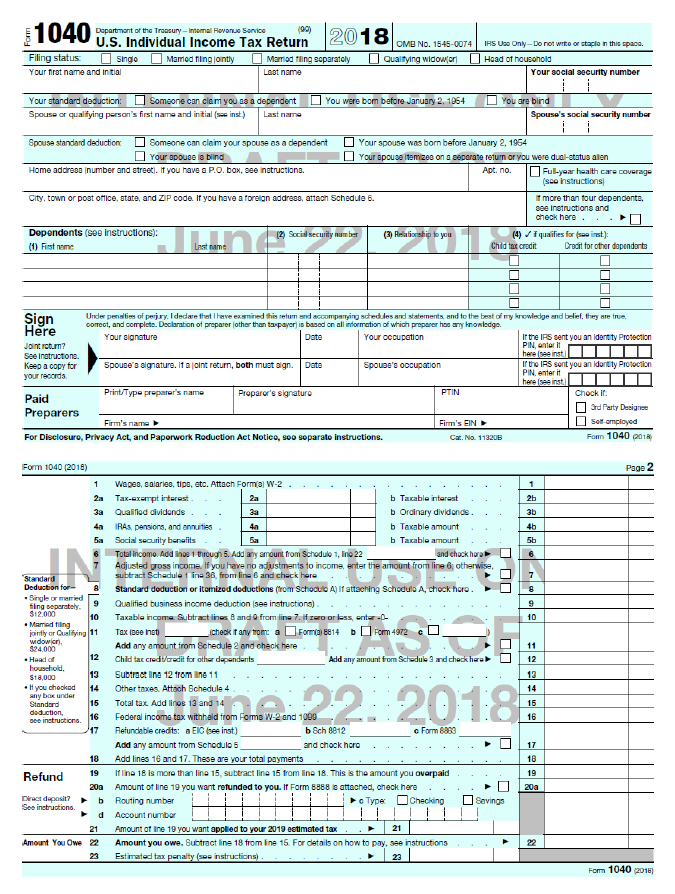

And believe it or not, you get to deduct the points even if you convinced the seller to pay them for you as part of the deal. The deductible amount should be shown on your 1098 form. Since there is a lot that goes into the buying and selling of a home, you may want to speak to a qualified tax professional so you don’t miss out on any of these potential tax benefits. As a new homebuyer, you will want to be on the lookout forForm 1098,“Mortgage Interest Statement”which is used to report mortgage interest, including points. This form can help you claim these deductions on your Form 1040.

Mortgage credit certificate

Therefore, if you install an elevator for $50,000 and it enhances the value of your home by $40,000, you can only deduct $10,000 ($50,000 – $40,000). If your adjusted gross income is over $100,000, the deduction phases out and eliminates if it is over $109,000 ($50,000 and $54,500, respectively, if you're married but file a separate return). Furthermore, the tax credits you receive will be heavily influenced by your state, whether you are a first-time home buyer, and the use of the property.

Upon purchasing a home, it is easy for the consumer to become quite confused with the situation, let alone the handling of settlement charges when it is time to file income tax returns. More often than not, when a consumer takes a mortgage to buy a house, or to refinance their current home loan, the incurring of closing costs will be inevitable. For most people itemizing their tax deductions, this is where you’ll find the biggest tax break for owning a home. In 2021, if you’re an individual taxpayer or a married couple filing jointly you can deduct the interest paid on up to $750,000 of mortgage debt. If you’re a married couple filing separately, the limit is $350,000.

Buying Your First Home

The seller should also be aware ofForm 1099-S, “Proceeds From Real Estate Transactions.” A seller will receive this form if the gain on the sale of the home is not entirely excluded from income. According to NCSHA, the program serves those who are generally first-time homebuyers and earn no more than the greater of their state-wide or area median income. Improvements, Improvements.Inheritance, InheritanceInsurance, Items not added to basis and not deductible.InterestHome mortgage, Home Mortgage InterestPrepaid, Prepaid interest. The IRS uses the latest encryption technology to ensure that the electronic payments you make online, by phone, or from a mobile device using the IRS2Go app are safe and secure.

If so, that amount will be shown on your settlement sheet. Include this amount in your real estate tax deduction. Note that you can't deduct the monthly payments into your escrow account as real estate taxes. Your deposits are simply money put aside to cover future tax payments. You can deduct only the actual real estate tax amounts paid out of the account during the year.

The measure amends the IRS tax law to provide up to $15,000 in federal tax credits to first-time home purchasers. Taxpayers who sell their main home and have a gain from the sale may be able to exclude up to $250,000 of that gain from their income. Taxpayers who file a joint return with their spouse may be able to exclude up to $500,000. Homeowners excluding all the gain do not need to report the sale on their tax return. For tax purposes, a deductible is an expense that can be subtracted from adjusted gross income in order to reduce the total taxes owed. Be sure to include any interest that you paid as part of your closing.

Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit. If an estate tax return wasn't filed, your basis is the appraised value of the home at the decedent's date of death for state inheritance or transmission taxes. If you contracted to have your home built on land that you own, your basis in the home is your basis in the land plus the amount you paid to have the home built. If you built all or part of your home yourself, your basis is the total amount it cost you to build it.

You should spend some time looking into your tax deductions if you are buying a house. A tax expert should be consulted if you need assistance with the specifics of your situation to make sure you are taking full advantage of all the tax breaks that are available to you. If you previously rented, all of your money went to the landlord, and none of it was tax-deductible.

If you meet this criteria, the move must be due to a military order resulting in a permanent change of station. You can claim all of the unreimbursed expenses for yourself, your spouse, and your dependents. And it’s not just storage and traveling expenses to your new home that you can claim. You can also claim household goods, personal effects, and lodging expenses incurred as a result of your move. When you get your mortgage you have the option to pay a portion of your interest in advance to reduce your monthly mortgage payment.

This means you report income in the year you receive it and deduct expenses in the year you pay them. Interest paid on disaster home loans from the Small Business Administration is deductible as mortgage interest if the requirements discussed earlier under Home Mortgage Interest are met. The amount of the refund will usually be shown on the mortgage interest statement you receive from your mortgage lender.

After he received the house, no events occurred to increase or decrease the basis. If Andrew sells the house for $120,000, he will have a $20,000 gain because he must use the donor's adjusted basis ($100,000) at the time of the gift as his basis to figure the gain. Here are some settlement and closing costs that you can't deduct or add to your basis.

Biden’s $15,000 First Time Homebuyer Tax Credit Proposal

Enter the amount of your deductible state and local real estate taxes on Schedule A , line 5b. The answers you provide will enable them to help you claim the home buyer tax credits and deductions you qualify for. If you are unsure how to answer a question, there are tax experts readily available to help you.

Many monthly house payments include an amount placed in escrow for real estate taxes. You may not be able to deduct the total you pay into the escrow account. You can deduct only the real estate taxes that the lender actually paid from escrow to the taxing authority.

No comments:

Post a Comment